indiana tax payment status

45 state tax for in-state residents - 3060150 - 44892000. First Merchants Bank Mooresville and Morgantown.

Cookies are required to use this site.

. Estimated tax installment payments may be made by one of the following methods. Two ways to check the status of a refund. Ad See If You Qualify For IRS Fresh Start Program.

This Tax Warrant Collection System is designed to help You to make. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law. Pay Your Property Taxes.

If you receive student loan forgiveness in Indiana for example you can expect to pay 323 in state taxes for 10000 in debt relief and 646 in state taxes for 20000 in forgiveness. You do not need to be a customer to make your tax payment however you must. Social Security number of taxpayer.

SBAgovs Business Licenses and Permits Search Tool. Exact amount of the refund. Information about novel coronavirus COVID-19 INgov.

We Help Taxpayers Get Relief From IRS Back Taxes. Your average net per year. Free Case Review Begin Online.

Indiana Small Business Development Center. Most Hoosiers who filed a 2020 tax return in 2021 should have received their automatic taxpayer refund via direct deposit or mailed check by now More than 15 million. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

Cookies are required to use this site. You may pay at the following banks. 583633045 After 30 payments.

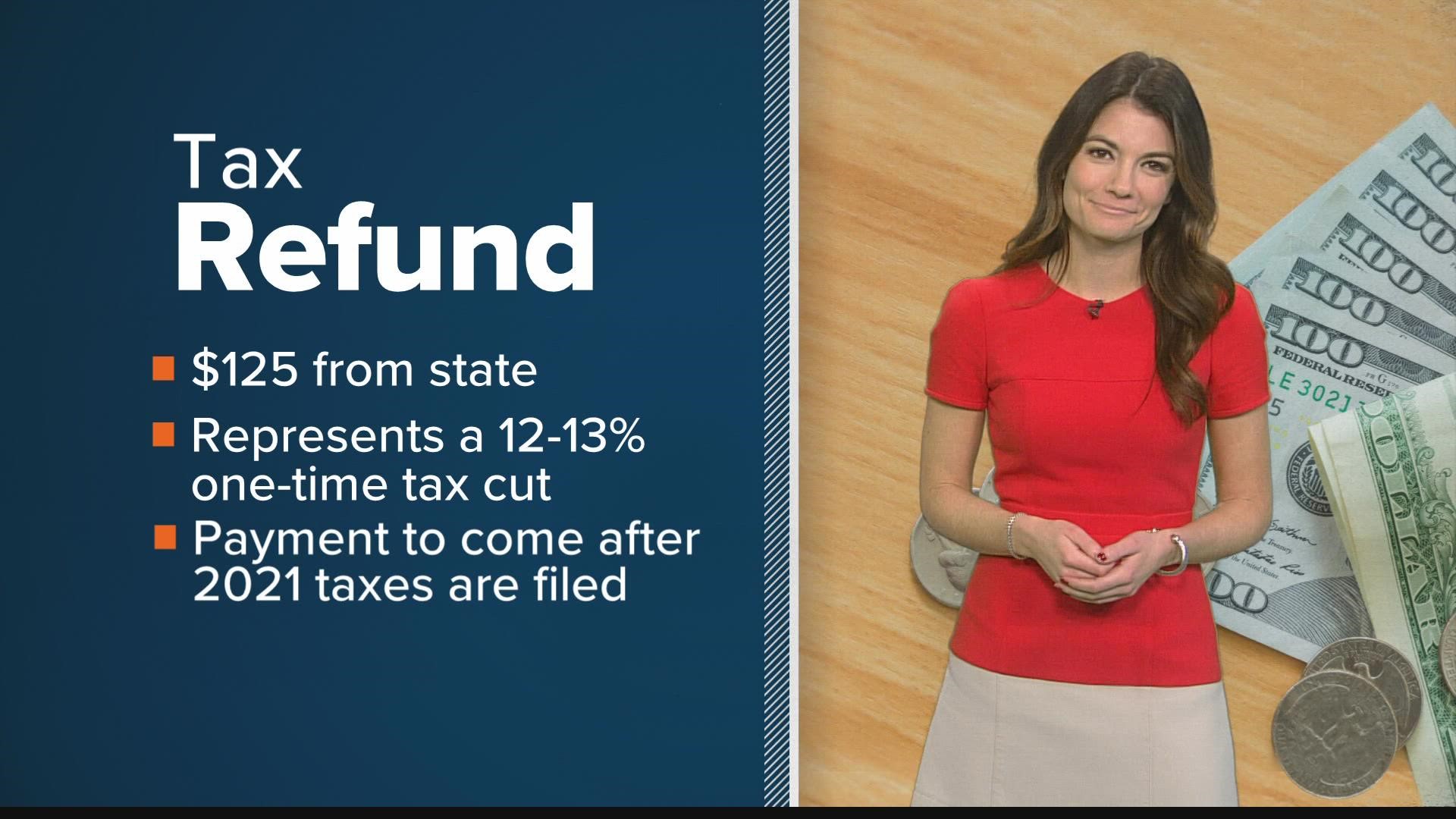

Residents who filed their taxes in 2020 are eligible for a 125 taxpayer refund which will also automatically qualify them for an additional 200 refund according to the state. How to Check the Status of Your Refund What youll need. If you have an account or would like to create one or if you.

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for. Department of Administration - Procurement Division. Your browser appears to have cookies disabled.

Your browser appears to have cookies disabled. The Indiana Department of Revenue offers the following e-services portals for individual income tax customers business tax customers and motor carriers. 39818995 Your net payout.

Indiana Department Of Revenue Today Is The Official Start Of Individual Income Tax Season For 2021 Remember You Have Until April 15 2021 To File Your Tax Returns Or File For

Dor Indiana Department Of Revenue

Real Tax Resolutions In Indiana 20 20 Tax Resolution

A Review Of Indiana S State Tax Payment Plan

Dor Owe State Taxes Here Are Your Payment Options

Dor Completing An Indiana Tax Return

Tax Claim Indiana County Pennsylvania

Indiana Sales Tax Form St 103 Fill Out Sign Online Dochub

Direct Payment Of 250 Sent Out Now With A Bonus 450 Due In Weeks From 1billion Pot Who Is Eligible The Us Sun

Bonus 125 Refund Coming To Indiana Taxpayers But Not Quite Yet Wthr Com

2022 State Tax Reform State Tax Relief Rebate Checks

Clark County Indiana Treasurer S Office

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

Indiana Dept Of Revenue Inrevenue Twitter

Direct Payments When Will Indiana Residents Get Their 200 Check Fingerlakes1 Com

The Ultimate Guide For Quarterly Tax Filing Requirements For Indiana Employers

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

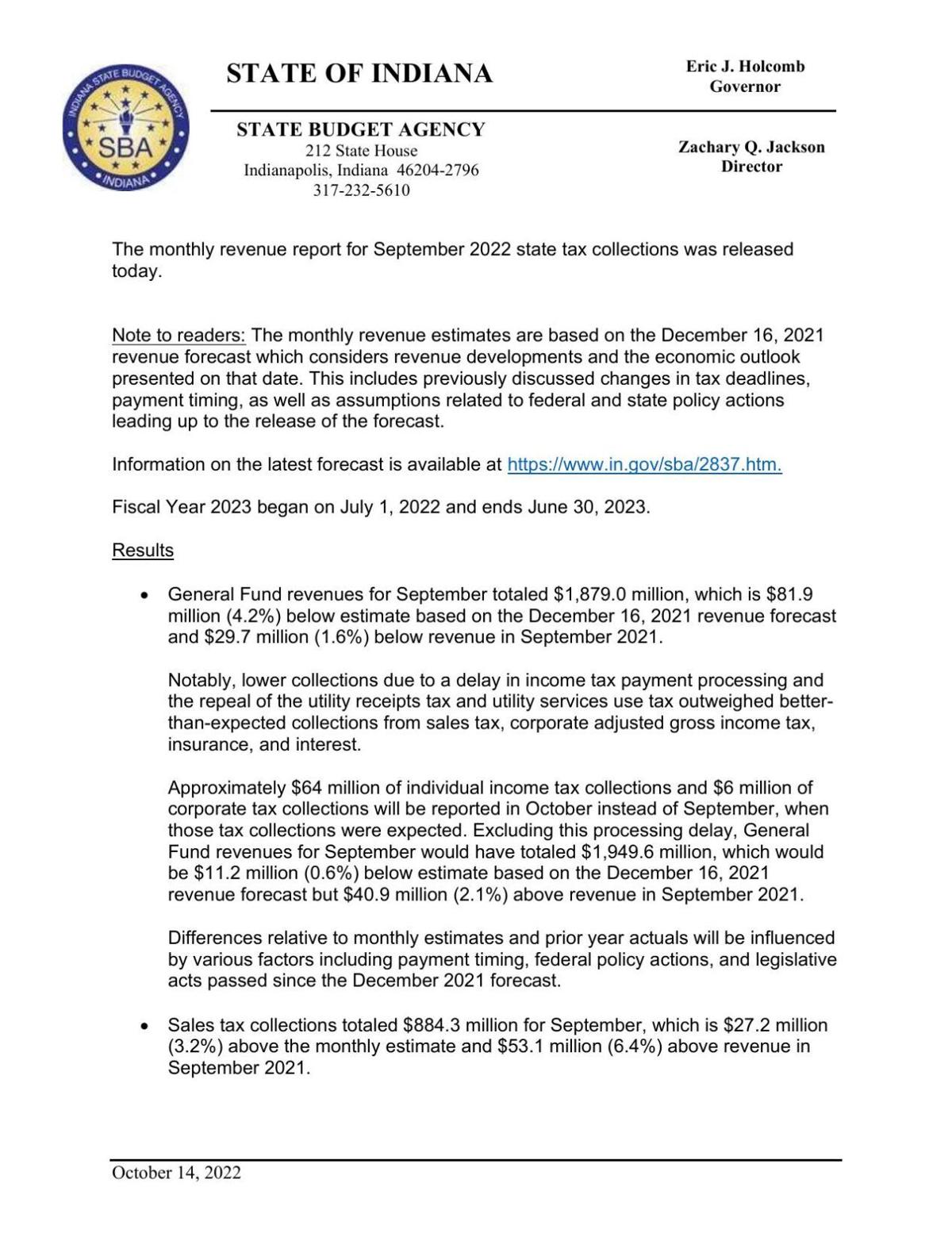

Indiana Ends First Quarter With 118 2m In Extra Tax Revenue

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits